Disclosure: We get a commission for some links on this website. You don’t have to use our links, but we’re very grateful when you do. Opinions expressed here are the author's alone, and have not been reviewed, approved or endorsed by our partners. Here’s our Advertiser Disclosure.

By: Zach – @MinnTraveler– You may have heard the news that the incredibly popular Fidelity Investment Rewards American Express Card, issued by FIA Card Services (Bank of America), is soon to be no longer. Fidelity announced late last year that they would be casting aside both B of A and American Express in favor of a Visa Signature Card issued by Elan Financial Services, a subsidiary of US Bank. This was big news because this card is a hit for Fidelity, even outside of the travel hacking world. The card earned (and will continue to earn) 2% cashback on all purchases when redeemed into an eligible Fidelity account, including their pseudo-checking “Cash Management Account.” But could it be better?

When it was announced that US Bank would be taking over this portfolio, there was immediate speculation that this card would actually earn FlexPoints. The press release alluded to redemption options which included travel and gift cards, in addition to the obvious redemption into a Fidelity account. To many, including FrequentMiler, this sounded a lot like the FlexPoints earned on US Bank’s FlexPerks cards. This speculation was based on the fact that the FIA AMEX actually earned a currency called “WorldPoints.” These were Bank of America’s failed attempt at a proprietary rewards currency in the same vein as Chase Ultimate Rewards and American Express Membership Rewards programs. Those who knew this also knew that you could use WorldPoints for travel redemptions in a way that turned the card into an “Up to 2.8% Cashback” card. It would make sense then, that US Bank would use their already developed proprietary currency as the back-end for this rewards program. To put it simply, this would be huge! FlexPoints can be redeemed for up to 2-cents per point when redeemed for airfare. The Fidelity Visa earns 2 points per dollar spent, meaning that this could be an “up to 4%” card! There were even a few reports on Reddit that an Elan CSR quoted travel redemption options in line with the “up to 2-cents per point” value of FlexPoints, seemingly confirming everyone’s wildest dreams.

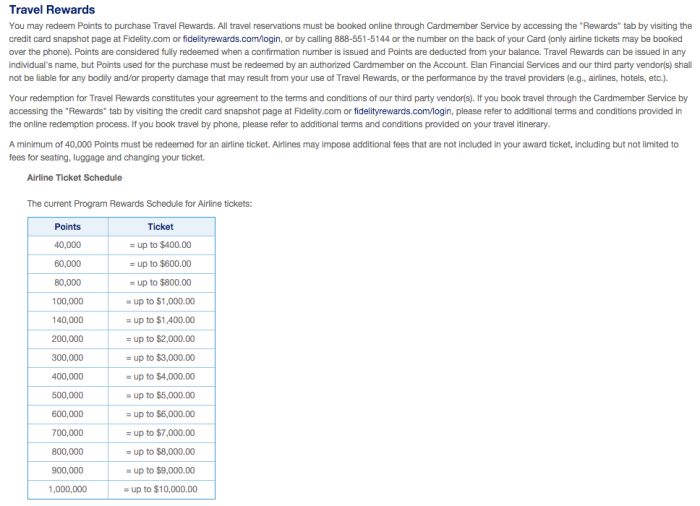

This is where I remind you of the old adage about things that sound too good to be true. I applied for and was approved for this card last week. I had visions of unrestrained, wild MS on a card that would make my Nationwide Buxx cards useful for something other than meeting minimum spends. I came home from work to find the card in the mail and was quick to set-up online account access through Elan. I made a beeline for the rewards information and found a little link titled “Program Rules” This is where I was met with disappointment:

As you can see, per the official Rewards Program Rules, the points earned on the Fidelity Investment Rewards Visa are only worth up to 1-cent each when redeemed for airfare. You can also redeem for other travel options such as “air and hotel packages,” hotel rooms, and car rentals, but the redemption rates for those are so bad they’re not even worth mentioning. Since you only get the full value if you find the perfect airfare at exactly $400, $600, $800 etc., you would be better off redeeming these points directly into a Fidelity Cash Management Account and using that money for paid airfare.

How do I feel about this? On one hand I’m disappointed that I wasn’t one of the first people to have what would have been one of the best cards ever for those in our hobby. On the other hand, it makes total sense. We’ve seen time and again that a 2% everywhere card is hard to make profitable and is often simply a loss-leader….especially on a Visa as opposed to American Express, given Visa’s lower interchange rates charged to merchants. A 4% card would surely have been unsustainable financially, and it would have likely been something you could only have milked for a quick minute before US Bank and Fidelity realized they were bleeding money.

I’ll try to end on a hopeful note and say that this may not be the last word on our hope for a 4% card. As FrequentMiler speculated, it may be possible to get the full 2-cents per point value if you transfer these points to a true FlexPerks card. From there you could redeem them like any other FlexPoint. Unfortunately, I don’t have a FlexPerks card, so I can’t test the waters on that. Honestly, I’m counting on this working. At the same time, this hobby is all about looking for a loophole and hoping it works the way you want it. In the meantime I’ll join my fellow churners in collective travel-hacking-prayer and hope against hope that our 4% dreams may still be realized.

If you enjoy the content on Loophole Travel, Like us on Facebook, Follow @loopholetravel on Twitter, and subscribe to our weekly newsletter!

Editorial Disclaimer: Opinions expressed here are author's alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Disclaimer: The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.